“We are living our dream. Dreams are a lot of work!”

– Don Zasada

In The Beginning

Don Zasada and Bridget Spann met in Chile while volunteering as community organizers in a rural village. After their volunteer commitments concluded, the couple moved to Boston. Don served as the Director of Agriculture for The Food Project, where he worked on a 20-acre farm parcel in Lincoln, Massachusetts, (just outside of Boston) that aims to engage young people in sustainable agriculture. The food raised on the farm is sold through Community Supported Agriculture (CSA) programs and farmers markets and is also donated to various hunger relief organizations. Don loved the work, but he was living as a commuter farmer and there was no opportunity to live and farm onsite. Meanwhile, Bridget worked as a domestic violence advocate at Massachusetts General Hospital. After a little while, the two wanted to move away from the city and find a long-term farming situation. They also wanted to have a family, but did not want to raise their children in Boston. The couple began their search for land and was initially attracted to affordable land in Maine, but the properties were too far from direct markets.

Eventually, they saw an advertisement in The Natural Farmer, a quarterly newspaper publication of the Northeast Organic Farming Association (NOFA) – an umbrella organization with different state chapters that organize conferences, workshops, and educational materials for gardeners, farmers, consumers, and other stewards of the land. Sam and Elizabeth Smith, a farming couple in Berkshire County, Massachusetts, were interviewing successors to take over their farm. Don and Bridget had never thought to look for land in Berkshire County because they believed they “never could afford” the price of land there.

Don was already familiar with the Smiths, having visited their farm some years ago when he was an apprentice in the Collaborative Regional Alliance for Farmer Training (CRAFT) program. Once he saw the Natural Farmer advertisement, Don made arrangements to visit the Smiths and interview for the successor position. The first interview consisted of a farm visit and tour and the second interview involved the Smiths visiting The Food Project to see Don’s work there, and to have another meeting with both Don and Bridget. Don and Bridget then scheduled another weekend visit at Caretaker Farm for Don to work with the crew there for a day and for an additional opportunity to meet with the Smiths. By August 2004, the Smiths had narrowed down their selection for a successor to three candidates and ultimately offered the opportunity to Don and Bridget.

The arrangement the Smiths proposed would allow Don and Bridget to have access to affordable land with healthy soils in an area with direct marketing opportunities. The arrangement the four farmers came to was complicated, took multiple years to develop, and ultimately involved the sale of the land to a community land trust (Equity Trust); the sale of a conservation easement to the state of Massachusetts; a foundation (Williamstown Rural Lands Foundation, which eventually became the landowner); two ground leases; the sale of a farmhouse, buildings, and equipment; and both couples eventually living on the land in separate farmhouses.

Exploring Land Trusts and Ground Leases

The Smiths had been exploring different options for the succession of their farm with Equity Trust and the Berkshire Community Land Trust. Equity Trust’s mission is “to promote equity in the world by changing the way people think about and hold property.” To that end, Equity Trust works to preserve farms for farmers, provides counseling on land tenure issues, strives to promote alternative forms of farm ownership (such as long-term ground leasing), and aims to increase community access to local food. The Berkshire Community Land Trust is similarly premised on a “democratic system for managing the Commons.” The Berkshire Community Land Trust promotes community ownership of land as the best way to ensure “permanent access, control, affordability and stewardship, now and for future generations.” In particular, it supports community owned farmland and homes as a means to reduce farmer debt and allow for increased food security by supporting local production.

A key feature of the Caretaker Farm succession deal involved the use of long-term ground leases. Long-term leases can be anywhere from 10 to 99 years in duration and afford a certain amount of predictability and stability for farmers because they know they will have access to the leased land for several growing seasons. Ground leases are a type of long-term lease that allow the farmer to purchase and own all of the buildings and structures on a property, but pay rent for the farmland. A ground lease arrangement allows farmers to build equity in the structures on the property while requiring less up-front capital because farmers can pay rent for the land instead of purchasing the expensive farmland outright (usually requiring a significant down payment and a mortgage loan).

Both Equity Trust and the Berkshire Community Land Trust have created “model” long-term leases that can then be customized for individuals’ unique circumstances. The two couples decided to customize Equity Trust’s ground lease because it offered a means to build equity based on the value of the farm. The couples also liked that Equity Trust provided commentary to accompany its lease, which explained the language in various clauses and made the lease easier to understand. Equity Trust provided the couples with valuable consulting advice regarding fundraising and Bridget recalls that Equity Trust’s technical and legal consultation regarding how to structure the deal was essential. Eventually, Equity Trust served as a pass-through organization facilitating the deal by purchasing Caretaker Farm and re-selling it to the Williamstown Rural Lands Foundation (to be leased and farmed by Don and Bridget).

In addition to working with Equity Trust, Don and Bridget and the Smiths also consulted with bankers and their respective attorneys regarding the ground lease and the farm buildings that existed on the property. Two farmhouses already existed on the property, so both couples could live on the property simultaneously. The two couples scheduled a meeting with First Pioneer Farm Credit (also known as Farm Credit East) and their respective attorneys to start discussing the details of the transition.

The Farm Succession Arrangement

A Conservation Easement

On February 12, 2003, the Smiths sold a conservation easement to the state of Massachusetts for $252,500. In Massachusetts, this type of conservation easement is called an Agricultural Preservation Restriction (APR) and the state becomes the owner of the easement. Not only does an APR prohibit development on the conserved land, but it also places an affirmative burden on the landowners requiring the land to be kept in active agricultural use. Thus, the APR helps ensure farmland remains in farming, and simultaneously lowers the value of the farmland to make it more affordable for farmers.

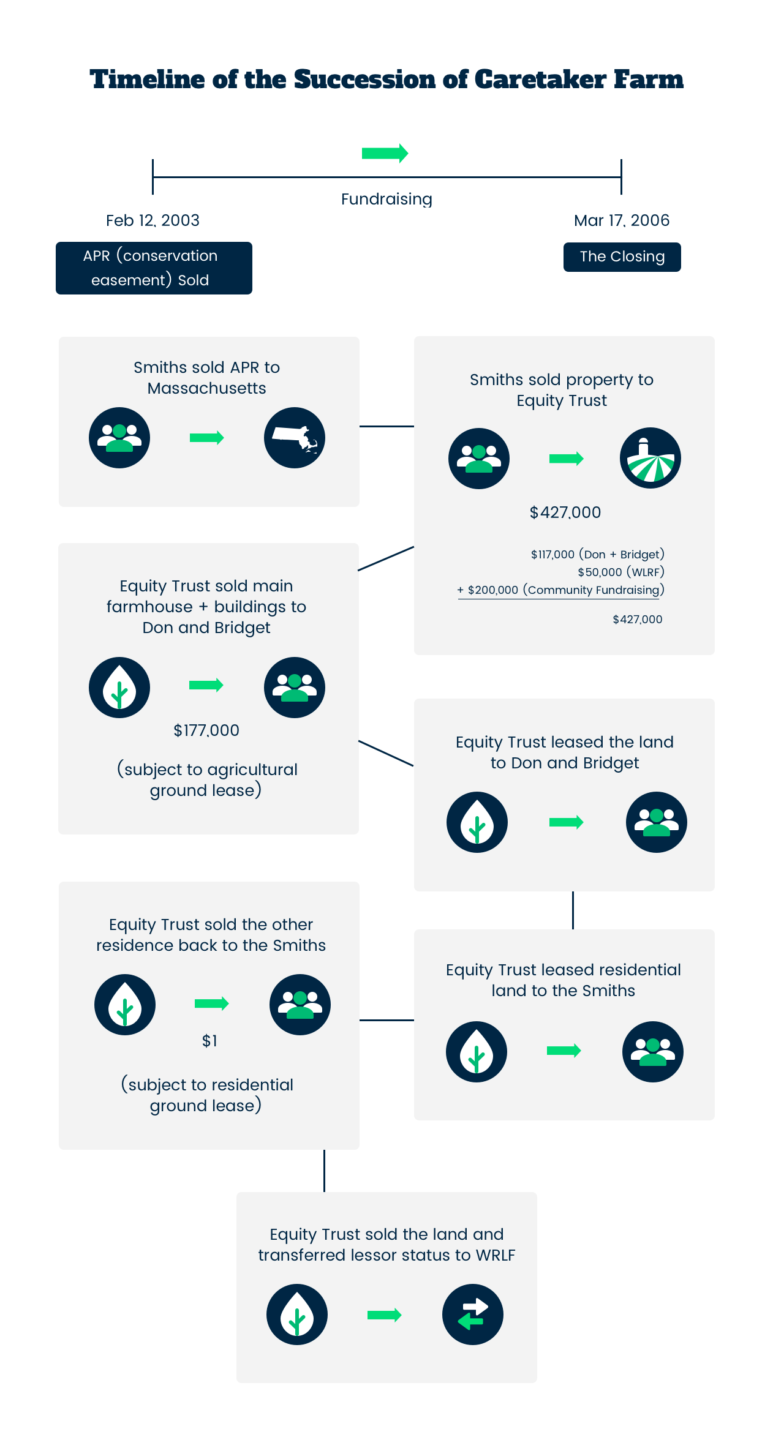

A Community Fundraising Effort Allowing Equity Trust To Purchase Caretaker Farm From The Smiths (For Eventual Re-Sale To Williamstown Rural Lands Foundation)

A key part of the farm succession plan involved Equity Trust purchasing Caretaker Farm from the Smiths (to be immediately resold to the Williamstown Rural Lands Foundation), and then leasing the land back to the Smiths and Don and Bridget via ground leases. However, before this purchase could take place, Equity Trust needed help raising funds to purchase the property. After the Smiths sold the APR to the state of Massachusetts (lowering the price of the Caretaker property), a local committee in Williamstown, Massachusetts, began a fundraising campaign to support Equity Trust in making the initial purchase from the Smiths. Thanks to money raised from CSA members, the Smiths’ friends and family, and funds contributed from the state’s Community Preservation Act (a law that sets aside a certain amount of tax money each year to fund projects intended to preserve agricultural and recreational open spaces), the community was able to raise $200,000 to contribute towards closing the deal.

The Closing: Equity Trust Buys The Land, Creates Two Ground Leases, And Re-Sells The Land To Williamstown Rural Lands Foundation

On March 17, 2006, the Smiths closed on the sale of the Caretaker property to the Williamstown Rural Lands Foundation (via Equity Trust). The deal involved many intricate pieces, and all the pieces had to be taken care of on the same day. First, the Smiths sold their entire property (35 acres of land, two farmhouses, buildings, and structures) to Equity Trust, subject to the Massachusetts APR (conservation easement) for $427,000.

Then:

- Equity Trust executed two separate ground leases – one agricultural (with Don and Bridget) and one residential (with Sam and Elizabeth Smith)

- Equity Trust simultaneously sold the main farmhouse and other buildings on the property to Don and Bridget for $177,000, subject to the agricultural ground lease

- Equity Trust sold the second residence back to the Smiths for $1 (because the value of the second home was purposefully not factored into the original sale), subject to the residential ground lease (which does not have the many restrictions that are present in the agricultural lease)

- Equity Trust also sold the underlying farmland to the Williamstown Rural Lands Foundation (WRLF) – a land trust that has been dedicated to preserving open spaces for future generations since 1986 and promotes projects involving land conservation and affordable housing

- By selling the underlying farmland to WRLF, WRLF became the “lessor,” so that WRLF is the landlord for both Don and Bridget’s agricultural ground lease and Sam and Elizabeth’s residential ground lease

Transaction Summary Chart

At the end of the closing, with 16 people around the table (five of whom were attorneys), the parties’ arrangement concluded as follows:

| Sam & Elizabeth Smith | Senior retired farmers; owners of the second residence; tenants with respect to the land underlying the second residence (with WRLF as landlord per the residential ground lease) |

| Don & Bridget | Junior farmers; owners of the main farm residence and buildings; tenants with respect to all of the remaining land (with WRLF as landlord per the agricultural ground lease); the remaining land also has the Massachusetts APR (conservation easement) attached |

| WRLF | Owner of all the Caretaker Farm land, which is subject to the Massachusetts APR (conservation easement); landlord for both the agricultural ground lease (with Don and Bridget as tenants) and the residential ground lease (with Sam and Elizabeth as tenants) |

| State of Massachusetts | Owner of the APR (conservation easement requiring the land be kept in farming) |

| Equity Trust | Served as the facilitator and pass-through organization for the deal. Equity Trust’s goal was to encourage land trusts to become owners and lessors of land to assist with moving beyond mere farmland preservation to preserving active working farms where farmers are able to live on the land they work |

The Nuts and Bolts Of Don & Bridget’s Financing For The Farm House and Buildings, and the Ground Lease Arrangement

In terms of Don and Bridget’s financing, they were able to contribute $40,000 towards the purchase price of the main farmhouse and buildings and then were able to obtain funds for the remaining amount through a leasehold mortgage from a local bank. Don and Bridget also took out a separate loan with First Pioneer Farm Credit in New York to finance their purchase of all the farm equipment.

Under Don and Bridget’s 99-year agricultural ground lease, they pay rent to WRLF in an amount that is calculated as the monthly fair rental value of the Leased Premises, times twelve, on an annual basis each November 15. This calculation recognizes that certain costs of ownership, including the cost of insurance and property taxes, are paid directly by the tenants (Don and Bridget); it also recognizes that use of the Leased Premises is restricted by the lease in ways that reduce the fair rental value, and finally that Don and Bridget will be providing certain benefits to the landlord (WRLF) – including, but not limited to, preservation and enhancement of soil quality and protection of the environment (as required by the lease). The annual ground lease fee was initially set at $680 in 2006, and is subject to adjustments every five years based on the Consumer Price Index. In addition, Don and Bridget pay annual taxes on the property (both land and buildings) to the town of Williamstown and pay for insurance coverage that lists WRLF as an additional insured. It is important to note that many people in the surrounding areas allow farmers to hay their fields for free or at very low costs just to keep the land in pasture, so the going rate for farmland rental was not high.

Additional Details Relevant To Future Generations

Should the Smiths want to move and sell their house, WRLF has a right of first refusal to purchase the home. Upon the Smiths’ deaths, they can choose to leave their house to anyone who would be willing to enter into and abide by the terms of the residential ground lease with WRLF. Importantly, land underlying the Smiths’ residence (just under an acre) is not subject to the Massachusetts APR affirmative farming requirement. The only condition for buying or inheriting the house is that the new owner adhere to the lease with WRLF.

Similarly, should Don and Bridget want to move and sell their house, they are permitted to sell the buildings to anyone who is deemed a “qualified person,” which is defined in the lease as a “person or group of persons who have demonstrated to lessor WLRF to their satisfaction that they understand and accept the terms of the lease, and are able to and understand they will use the lease in full compliance with all requirements and restrictions.” In addition, Don and Bridget’s lease is inheritable to the extent that the person who inherits can and will farm the land. In the event that the house could not pass to their children because they are too young (their son and daughter are 9 and 12, respectively), the property would be sold and transferred to a qualified person but the value of the sale would go to the children.

In the event that Don and Bridget leave the farmhouse to someone who later decides not to adhere to the terms of the agricultural easement or the agricultural restrictions in the lease, WRLF has the option to find the person in default of the lease, which gives the WRLF as the landlord the option to terminate the lease. In that event, the landlord could enter any part of the Leased Premises and repossess the entire Leased Premises, and expel the tenants. This could may trigger a sale of the farmhouse/buildings, and then the tenant would be required to surrender possession of the improvements as well as the Leased Premises.

If Don and Bridget or an eventual successor tenant is unable to find a buyer for the improvements within 12 months of the lease’s expiration, WRLF as landlord would purchase the improvements at the “as Restricted Market Value” within 36 months of the lease termination date. The landlord could also bring an action at law or in equity for money damages or equitable relief. So it is the tenant’s obligation, and in the tenant’s interest (even if the person has been evicted), to find a new buyer. If no buyer is found, then WRLF has an obligation to purchase the buildings (for the as-restricted price), but would have up to 36 months to pay for it (likely enough time to run a fundraising campaign). If WRLF were forced to purchase the property, it would pay for its as-restricted agricultural value, but then, as both landlord & tenant, would own a more valuable property (with ownership of both the land and the buildings) and could determine a next-best use for the property if no farmer is to be found.

The Current Farm Business

Two years ago, Don and Bridget created a Limited Liability Company (LLC) and placed the farmhouse, the structures, and all the improvements (which they also own) into it. The farm currently supports a CSA for 265 families who purchase CSA shares each season.

Don and Bridget are already thinking about their own retirement and succession plans because in less than a decade, Don will be in his late 50s. They do not know yet if their children will want to take over the farm. Thankfully, the couple has a financially stable business that allows them to set aside and save money each year to fund their retirement. They also have equity in the buildings and improvements on the property. Bridget is grateful that the farmland is not their nest egg: “We will not have to face the heartbreak of selling the farm for development.”

Reflections

Looking back, Bridget reflects that the entire process “felt both energizing and exhausting.” She and Don had so many conversations with so many different people – including other farmers, field agents with various land trusts in New England, and other private owners. She says everyone who spoke to them was helpful and eager to share their experiences and ideas. She also notes that it was helpful to speak with one of the Smiths’ prior apprentices who had contemplated taking over the farm at one point. The former apprentice eventually decided not to proceed with the succession plan because it became too challenging for the parties to resolve all the aspects of the deal, including how to make the finances of the farm transfer work. He commented to Bridget that he did not have a lot of resources and was the only one coming to the table without an attorney or an accountant. Bridget says she and Don learned from this experience that although it was hard to devote funds to an attorney and accountant, these were expenditures necessary for a successful farm transition.